Hi Moaters,

I was 16 years old, standing in the middle of a tennis court, when Coach Layman nailed me in the head with a tennis ball in front of my entire high school team.

"GET OUT OF NO MAN'S LAND!" he yelled.

I looked down. I was standing between the baseline and the net; a space I imagined being the most optimal area to stand.

"Attack the net or get back!" he shouted."

23 years later, Coach Layman's voice still echoes.

I'll see a company announcement and think: "They're standing in no man's land." A dangerous position.

Brilliant teams. Great products. Ambitious visions.

And they have no idea they're in the kill zone.

Today's insight: The one strategic rule every tennis player knows that most strategic leaders break.

What this means for you: A simple 3-question audit you can run Monday to figure out if your strategy is stuck in the danger zone, and how to get out.

Did someone forward this email to you? Click here to subscribe so you don't miss out on future issues.

Why the Middle Feels So Good

Here's the thing about no man's land in tennis: it FEELS strategic.

You're close enough to the net to volley. Close enough to the baseline to rally. You think you're covering all your options.

But you're actually vulnerable everywhere. Balls land at your feet. You can't reach volleys effectively. You don't have time for proper groundstrokes. When your opponent hits wide, you have minimal angle to chase.

Business positioning works the same way.

The middle feels safe. You're hedging your bets. Serving everyone. Building features for every segment. Pricing between premium and budget.

Your board loves it. "Look how big our addressable market is!" they say.

I see something different: a company standing exactly where they'll get destroyed.

And here's the brutal part: perfectly rational at every decision point.

Kahneman's research on loss aversion shows that losses hurt 2x more than equivalent gains feel good. So leaders avoid bold moves because the psychological pain of potential failure overwhelms the pleasure of potential success.

Middle-ground strategies minimize perceived maximum loss, even as they increase actual risk.

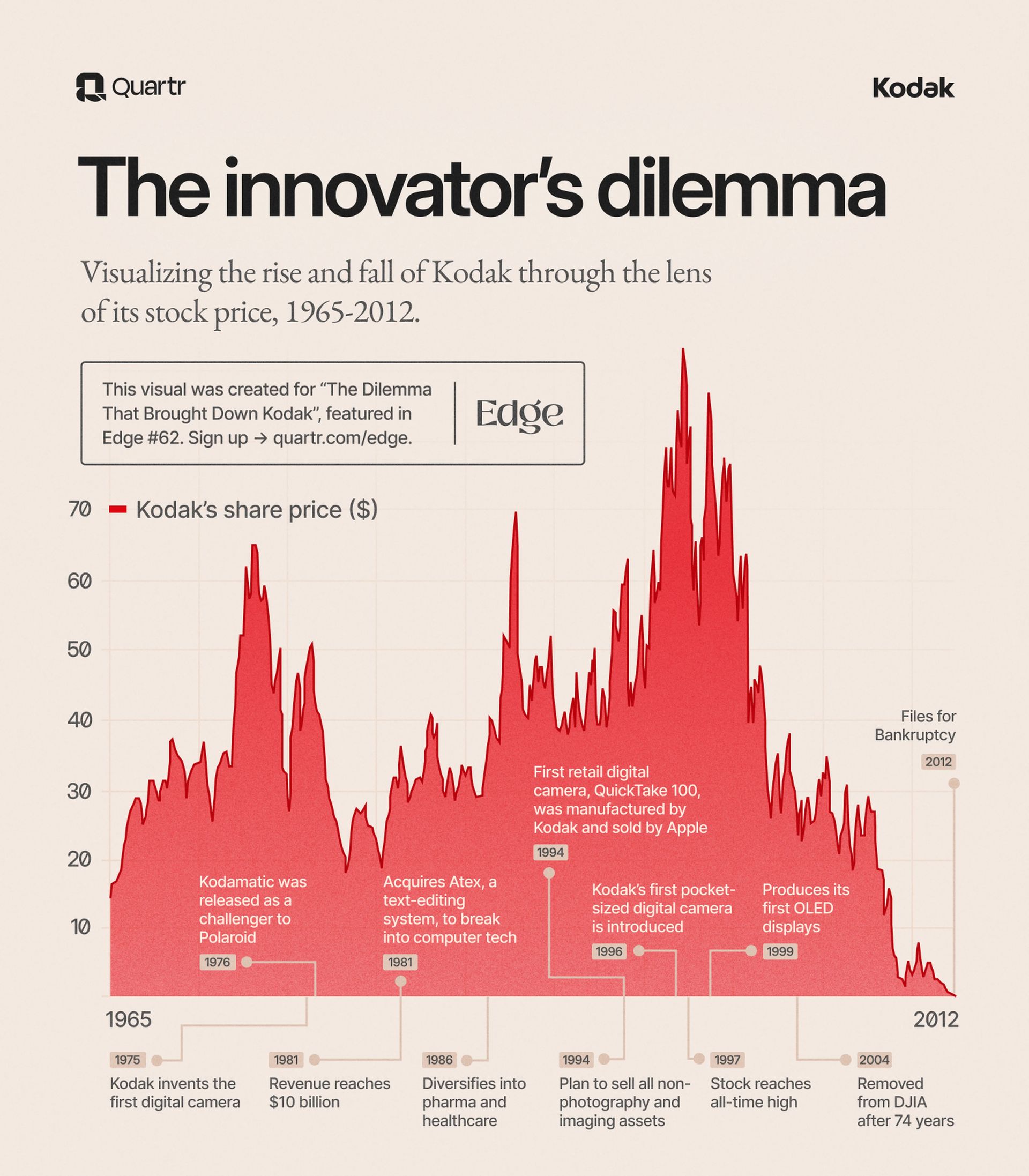

Consider Kodak. They invented the digital camera in 1975. They researched adoption rates in 1981 and correctly predicted they had 10 years to prepare. They accumulated over 1,000 digital patents.

Yet they still went bankrupt in 2012.

Source: Quartr

The problem wasn't ignorance. It was that continuing to invest in film made rational sense at every quarterly decision point. Until it didn't.

Nokia had the same issue. Leadership explicitly defined strategic agility as their competitive advantage. Yet INSEAD research found the organization regressed to "sluggish decision-making" due to matrix structure conflicts and a "fearful emotional climate."

They went from 40% global market share in 2007 to 1% in 2015, an 87.5% collapse. Not from technological blindness, but from standing in strategic no man's land.

If you loved this phone we can be friends

The Two Winning Positions (Pick One)

In tennis, there are two safe positions:

Baseline: Defensive positioning. You have time to set up groundstrokes. You can cover court width. You trade power for consistency.

Net: Offensive positioning. You cut off angles. You hit volleys at ideal height. You end points faster.

Both positions can win matches. But you have to commit to one.

Business works the same way.

Baseline Positioning = Cost Leadership

This is the Southwest Airlines playbook:

Single aircraft type (Boeing 737s only)

No seat assignments

No meals

Point-to-point routes (no hub complexity)

10-minute gate turnarounds

They sacrificed premium customers, business travelers, and international routes. In return, they became the most profitable U.S. airline for 47 consecutive years.

What it requires: Ruthless operational efficiency. Saying no to almost everything. Making every decision through the lens of "does this lower our cost structure?"

Net Positioning = Differentiation

This is the Apple playbook:

Premium pricing

Closed ecosystem

Obsessive design

Limited product line

They sacrificed price-conscious customers, enterprise IT buyers, and customization lovers. In return, they became the most valuable company in the world.

What it requires: Creating unique value that can't be copied. Making every decision through the lens of "does this make us more distinctive?"

The Exception (That Proves the Rule)

There's one scenario where middle positioning dominates: when investments scale across customer segments without proportional cost increases.

Amazon serves both bargain hunters and rare book collectors from a single platform. Barnes & Noble superstores offered better selection than specialists at lower prices than discounters. The key: their core technology investments scaled without adding proportional costs per customer.

Ron Adner's research at Tuck School of Business calls this "scalability inversion." When fixed costs are high but marginal costs are low, hybrid strategies can win.

But here's the catch: You need massive infrastructure investment to make this work.

If you don't have Amazon-level tech or Barnes & Noble-level real estate, you're not in a hybrid strategy. You're just stuck in no man's land.

The 3-Question Audit for Your Strategy

Run this test Monday morning with your leadership team:

1. The Coherence Test

Can every member of your team name your top 3 strategic priorities?

MIT research shows only 28% of managers can correctly list their company's priorities. If your team can't articulate where you're playing and how you're winning, you're in no man's land.

2. The Resource Test

Does 85%+ of your spending align with your stated position?

Look at last quarter's P&L. Are you investing like a cost leader (baseline) or differentiator (net)? Or are you spreading resources across contradictory priorities?

Roger Martin's research shows healthy companies have 85%+ resource alignment with their strategic choices. Anything less means you're hedging.

3. The Tennis Test

If I froze your company today, are you at baseline, at net, or stuck in the middle?

Be honest:

Baseline: Your competitive advantage is operational efficiency and cost structure

Net: Your competitive advantage is unique value customers can't find elsewhere

Middle: You're "pretty good" at both but exceptional at neither

If you can't clearly articulate which position you own, you're in no man's land.

And the market will punish you for it.

Get Out of No Man's Land

Here's your move if you're stuck:

Step 1: Pick your position

Look at your core competency. Where do you actually have an edge? Cost structure or unique value? You can't fake this—your financials will tell you.

Step 2: Cut ONE thing that doesn't serve that position

This quarter, eliminate one initiative, feature, or customer segment that dilutes your focus. If you're going baseline, cut the premium features no one pays for. If you're going net, fire the price-shopping customers dragging down margins.

Step 3: Reallocate those resources

Take what you just freed up and double down on strengthening your chosen position. Every dollar should make you more defensible where you've planted your flag.

The decision is binary: Attack the net or get back to baseline.

Either position can win. But only if you commit.

Standing in the middle guarantees you'll lose.

I think about Coach Layman's tennis ball at least once a week.

Not because the lesson was profound. Because it was true.

And I keep seeing companies make the same mistake I made on that court—thinking the middle is safer than the edges.

It's not.

'Til next time,

—Ali

P.S. Run that 3-question audit with your team and see what comes up. If it sparks something interesting (or uncomfortable), hit reply. I read everything and always curious what resonates.

About Me: I'm Ali, Head of Growth at Pricing I/O. We take a hands-on approach to help software companies stop guessing at pricing. Something about me, I've been called "annoyingly optimistic" by enough people that I'm starting to believe it.