Hi Friends,

In February 2020, a recruiter pinged me about a startup called Ramp.

"Corporate card company. Founded by the Paribus guys."

I was at a fintech company then. Asked around. My gut reaction? "Isn't this just another Brex? Visa and Amex will crush them."

COVID hit. The world stopped. I forgot about Ramp completely.

Fast forward 6 years, and I'm eating my words:

$16B valuation

$750M+ revenue

40,000+ customers

Source: Not Boring, CapIQ

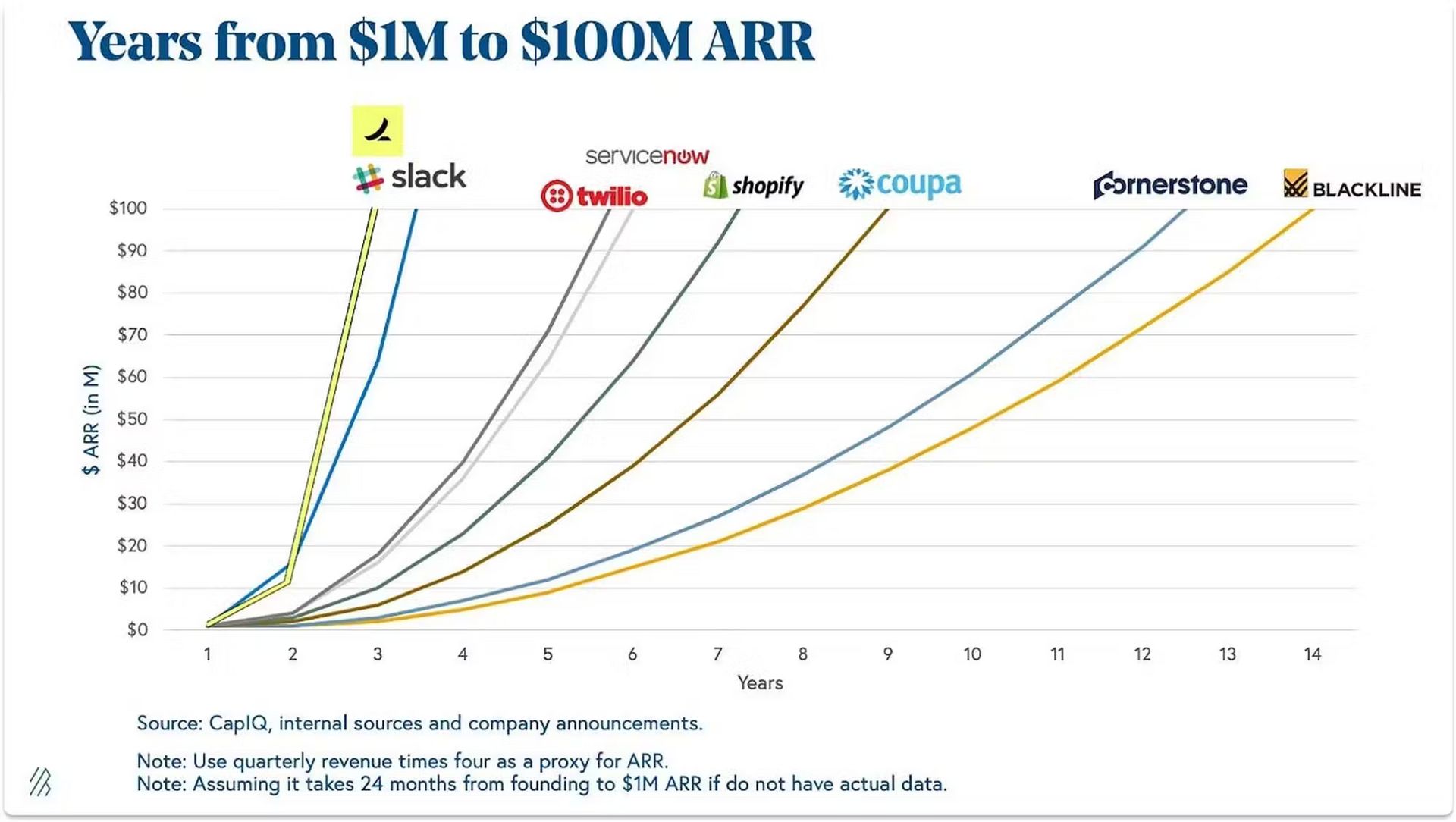

For perspective: Ramp hit $100M revenue in 2 years. American Express took 100 years.

Let that sink in for a moment.

And they did this during a pandemic. In New York. In a "crowded" market. In an industry that prioritizes compliance over innovation.

The title of this issue came from a sticky note I wrote months ago. I couldn't stop thinking about their growth story.

Over the last two weeks, I spent 23 hours deep-diving podcasts, newsletters, investor memos, team interviews, and founder content.

I narrowed it all down to 3 high-leverage principles you can apply to your business: strategy, velocity, and talent.

1. Strategy: Find What Everyone Missed

Eric Glyman (CEO) and Karim Atiyeh (CTO) built Paribus, a tool that automatically gets refunds when prices drop after purchase. Capital One bought it for $200M+ in 2016.

Working inside Capital One, they spotted something unsettling: The entire corporate card industry was built backwards.

That misalignment planted the seed for their next venture, Ramp.

As I wrote in Issue 004 with Alex M H Smith, the best strategies don't compete; they uncover truths everyone else missed.

On paper, "helping people spend less" sounds generic. Every vendor promises cost savings. So why was this insight hidden?

Because the entire credit card industry was structurally misaligned.

Traditional corporate cards (Amex, Chase, etc.):

"Earn 2% cash back on every purchase!"

"Get exclusive lounge access!"

"Collect points for travel rewards!"

Every feature is designed to drive more spending. More swipes = more revenue.

The hidden insight: Card companies made money when you spent more. So they'd never build tools to help you spend less.

"Most corporate cards are built to drive more spending. We're built to help you spend less. The average company saves 5% just by switching to Ramp."

Why was this actually hidden?

Industry blindness: Everyone assumed rewards = value.

Structural misalignment: Revenue models incentivized opposite behavior.

Customer acceptance: Companies tolerated inefficiency as "normal".

Mission as a Filter

Eric's mission for Ramp is crystal clear:

"Our mission is to help companies spend less money and spend less time."

He repeats this obsessively. In every interview, board meeting, and podcast. This isn't marketing speak; it's strategic discipline made into a mantra.

Eric also aligns this to a key north-star metric for the company: total dollars saved by customers. $600 million saved in 2024.

This mission became the filter for every product decision and expansion:

✅ Catch duplicate subscriptions automatically

✅ Rebook cheaper flights in real-time

✅ Flag budget overages before they happen

✅ Close books 8x faster

2. Velocity: Know What Moves the Needle

Ramp built an execution machine by identifying which inputs drove the biggest outputs.

They boiled their business into a first principles formula:

Growth = Purchase Volume × Interchange Rate – Funding Costs

"When we modeled which variable moved the needle most—it wasn't interchange rate. It wasn't margin. It was purchase volume. So we pointed the whole company to figure out how to go all-in to increase purchase volume."

This wasn't just analysis, it was cultural rewiring. Every team learned to think in inputs and outputs. No confusion. No competing priorities.

Time as Your Scarcest Asset

Every board meeting opens with one number: what day it is since the founding.

"We count days because it's a forcing function. If we're on day 1,866, we ask: are we shipping like a company that's 1,866 days old? Or are we wasting cycles?"

This input/output thinking applied to time itself. Eric and Karim could look at a period and see patterns of what worked and what didn’t.

Shipping at Startup Speed

The shipping of new features continues to be legendary in tech circles. Geoff Charles (Chief Product Officer) shares examples:

"When I joined in 2020, we were about 10 folks, about eight engineers, and in three months we built a competitor to Amex. Six months after that, we built a competitor to Expensify... We started expanding into accounts payable. It was three engineers, one designer, one PM, three months, and they hit it out of the park."

Other high-velocity wins:

Visa integration in 50 days (industry standard: 12+ months)

300+ product updates in 3 years.

Support tickets down 34%—not from more agents, but fewer issues

Your takeaway: Know your business equation and build a culture obsessed with input/output optimization. Every employee must know which output to prioritize and which inputs they specifically own.

3. Talent: Be Ruthless

Everyone knows great talent is better than average talent. Ramp ruthlessly acts on it.

More people = more coordination costs, slower decisions, diluted culture. Fewer great people = more velocity.

Rumor has it, Karim (co-founder & CTO) spent a year with only one OKR: hire the best engineers in the world. Not good engineers. The best.

Pay to Win

Most companies try to hire great talent at market rates. Ramp pays based on impact.

The math: Pay 2x salary for someone who does 5x the work = 2.5x efficiency gain.

Plus, their shipping velocity attracted top talent from Google and Facebook who felt their efforts weren't maximized at big tech.

Great engineers don't join for ping pong tables. They join companies that actually ship.

Your takeaway: Every hire should make your team faster, not just bigger. Most companies optimize for filling roles. Optimize for capability concentration. Your hiring bar determines your execution speed.

The Reinforcing Loop

Most companies optimize strategy, velocity, and talent separately. Ramp made them multiply each other:

Strategy → Velocity → Talent → Strategy

Each element maximizes the others:

A clear strategy creates velocity

Velocity attracts great talent

Great talent executes the strategy

Your 3-Question Audit

Strategy: Where is your industry structurally misaligned with customer needs?

Velocity: What single metric moves your business needle most?

Talent: Does each hire make your team faster or just bigger?

The magic: engineering all three to amplify each other.

Til next time,

—Ali

P.S. I found this video of Eric Glyman in an international Mandarin debate back in 2011. I don’t know Mandarin, but based on the comments, he did an amazing job.

Want to Go Deeper?

Across all my research, here I curated the best resources for understanding how Ramp operates:

🎥 How to Operate (Keith Rabois) - In multiple interviews, Eric boldly states that this video of Keith Rabois (Silicon Valley legend and Ramp’s board member) changed his life and considers this a must-watch for any founder.

🎥 How Ramp Grew To $16 Billion Business In 6 Years - The most recent and best podcast that shares Eric’s life and founder journey. Great job Wouter Teunissen!

🎥 How Ramp became the fastest-growing SaaS startup ever | Geoff Charles (CPO) - A must-watch & read done for any product leader by the great Lenny Rachitsky.

🎥 Building with High Velocity Execution | Eric Glyman (CEO, Ramp) | Founder Confidential - Eric's founder philosophies distilled in one clear video.

Each video has insights you won't find anywhere else. Worth the time investment if you are curious to learn how Ramp operates.

Ali Mamujee

About Me: I’m Ali. I advise B2B founders and executives to get clear on their strategy, story, and sales motion. I write this free weekly newsletter in hopes I can make you better, faster, and stronger in your career. Reach out if I can be of support to you.

Learn more about my story on LinkedIn.