Hi Friends,

This issue is about the power of tracing your influences. The people and ideas that quietly shape how you think, lead, and make decisions.

When you zoom out and connect those dots, you start to see patterns that explain your success, your blind spots, and your deepest instincts.

For me, that person was Warren Buffett.

What started as childhood curiosity about the back of a newspaper became a lifelong philosophy that shaped how I build, lead, and live.

The Spark

Every morning growing up, my dad would read the Houston Post before heading to work. From the living room, I’d see the newspaper stretched wide in both hands, covering his entire face.

I didn’t see him.

I saw the back of the newspaper.

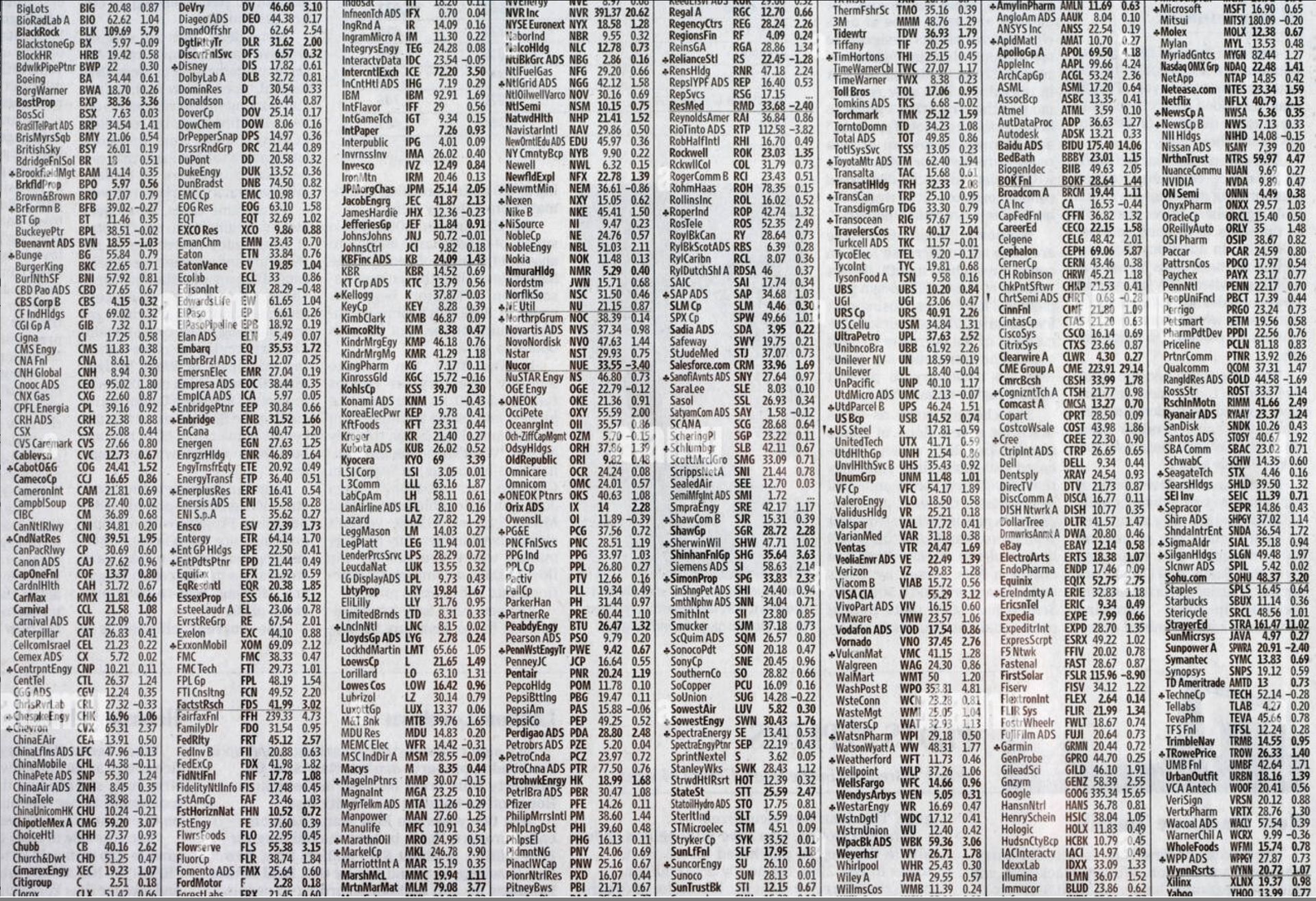

And on the back were hundreds of stock tickers printed in tiny, size-two font. Rows of strange symbols and numbers that looked like code from another universe.

What I saw every day facing me

What were these numbers?

Why did they change daily?

And who cared enough to print them every single day?

That curiosity built up until one morning I finally asked him:

“Dad, who’s the best at these numbers?”

Without hesitation, he said, “Warren Buffett.”

I’d never heard the name before. This was pre-internet, pre-YouTube, pre-Twitter threads explaining Berkshire Hathaway in 90 seconds. Buffett wasn’t a celebrity yet, he was just a quiet billionaire from Omaha known only by people into investing.

The mystery hooked me.

So I went to the library to learn more. I wandered through the finance aisle until a thick, beige book grabbed my attention:

The Intelligent Investor by Benjamin Graham.

I picked it up, opened the cover, and saw one line that sealed my fate:

“By far the best book on investing ever written.”

I didn’t know who Graham at the time.

But if this Buffett person called it the best book in the world, I was in.

I checked it out that day and started reading. I didn’t understand half of it, but the curiosity remained to learn more.

It was the first time business felt like a language worth learning.

The first time investing felt like a puzzle of logic, patience, and discipline.

And that quiet fascination, sparked by the back of a newspaper, would shape the next two decades of my life.

The Summer That Changed Everything

By high school, I knew I wanted to learn more. Buffett had studied under Benjamin Graham at Columbia University, so I decided to follow the same path in the only way a teenager could.

At 16, I applied to a summer finance program at Columbia, and somehow, I got in.

Walking through those same hallways, studying in those same classrooms, something clicked:

Understanding that changed the trajectory of my life. It shaped why I majored in finance at the University of Texas. Why I started my career in investment banking and fintech. I continue to be an avid investor.

And why Buffett’s philosophy still guides me today — not in investing, but in life.

BTW, the word “moat” I stole from Warren Buffet and inspired the name of this newsletter.

7 Lessons That Endured

Decades later, I still see Buffett’s fingerprints in how I work, lead, and make choices.

He’s the north star I return to when the noise gets loud. It’s his books that provide me clarity.

Here are 7 Buffett Principles that have quietly guided my career, from finance, to startups to leadership.

1. Simplicity Wins

“There seems to be some perverse human characteristic that likes to make easy things difficult.”

Buffett’s genius was clarity. He stripped away noise until only the essentials remained.

In business, simplicity multiplies execution. If your team can’t repeat your strategy in one sentence, it’s too complex.

👉 If it’s hard to explain, it’s hard to execute.

2. Focus Beats Diversification

Buffett doesn’t chase everything — he chooses a few bets and goes deep.

He calls diversification “protection against ignorance.”

The lesson? Spreading yourself thin guarantees mediocrity.

👉 Focus isn’t saying no to bad ideas — it’s saying no to good ones that distract from great ones.

3. Patience is a Superpower

Buffett’s wealth didn’t come from extraordinary returns — it came from extraordinary time horizons.

In leadership, patience is underrated. Real growth — in revenue, talent, or trust — compounds slowly, then suddenly.

👉 The faster you want results, the more expensive they get.

4. Reputation is Capital

“It takes 20 years to build a reputation and five minutes to ruin it.”

In business, your brand is just compounding trust in disguise.

Guard it relentlessly. Integrity scales faster than any marketing campaign.

👉 Your reputation is your most valuable asset and the only one you can’t buy back.

5. Communication Compounds

Buffett once said the best investment he ever made was a $100 Dale Carnegie course.

He learned that persuasion and clarity compound faster than capital. Because of Warren B., I enrolled myself in nearly half a dozen Dale Carnegie courses.

For leaders, your ability to simplify complexity — in a boardroom, Slack thread, or sales call — is leverage.

👉 If you can’t explain it clearly, you don’t understand it deeply enough.

6. Inner Scorecard > Outer Scorecard

Buffett lives by his own scoreboard, not the market’s.

He measures success by integrity, not applause.

That mindset builds resilience because external metrics fluctuate, but internal standards endure.

👉 Judge yourself by effort and ethics, not titles or likes.

7. Compounding Isn’t Just Financial

Buffett’s real magic is behavioral compounding, reading every day, choosing partners carefully, avoiding ego traps.

Small decisions, repeated consistently, create massive asymmetry over time.

👉 Habits compound faster than capital.

The Real Takeaway

Having time to reflect last weekend, I realized how a morning newspaper ritual would shape my entire life.

But it did.

And now, leadership has brought me here: helping others build moats that last.

Because Buffett’s greatest lesson isn’t about money. It’s about character.

He taught me that clarity, patience, and discipline aren’t just business traits, they’re life skills.

3 Buffett Prompts for You

Simplify: What’s one process, meeting, or strategy that’s gotten too complicated? How could you make it simple again?

Focus: What are you currently saying “yes” to that’s distracting you from what actually matters?

Compound: What small daily action, done consistently for five years, would completely change your trajectory?

We all have a “Buffett” in our lives, someone who taught us how to think clearly when everyone else was chasing noise.

Find yours. Study them. Let their wisdom shape your own philosophy.

And when the world gets chaotic, return to their principles because clarity is the ultimate competitive advantage.

Til next time,

—Ali

P.S. Who shaped your philosophy of work? Hit reply — I read every response.

About Me: I'm Ali, Head of Growth at Pricing I/O, one of the coolest companies in the world to have a front row seat of leading tech companies growth strategy. I write The Moat to help B2B leaders think differently about strategy, growth, and execution.